View FICO Credit Score

Keep tabs on this important number from Fair Isaac Corporation (FICO®).

Track and understand your credit score. It impacts all of your personal finances.

Get our Mobile Banking App

Use Mobile Banking to monitor your FICO® Score, including personalized key factors influencing your score.

The more you know...

Your credit score determines whether you qualify for loans, how much you'll pay, whether you're approved to rent an apartment and much more.

Reliable information

Partner Colorado Credit Union provides your score (updated quarterly) based on information from your Experian credit report.

This number carries a lot of weight

The higher your FICO® score, the better position you're in to qualify for loans and mortgages and take advantage of the lowest available rates. Your credit score also plays a factor when you're applying for a job or looking to rent an apartment. So knowing where your score stands and what you can do to improve it is crucial information.

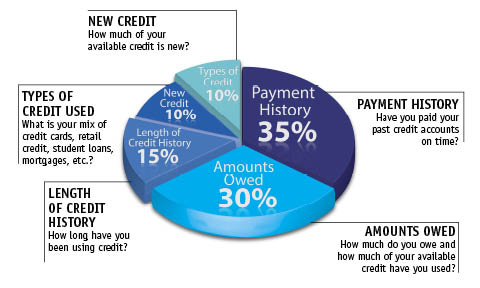

Components of Your FICO® Score

Frequently Asked Questions

FICO® Scores, the credit scores created by Fair Isaac Corporation (FICO), are the most widely used credit scores in lending decisions. Lenders can request FICO® Scores from all three major credit reporting agencies. FICO® develops FICO® Scores based solely on information in consumer credit files maintained at the credit reporting agencies. Understanding your FICO® Score can help you better understand your credit risk and allow you to effectively manage your financial health. A good FICO® Score means better financial options for you.

When a lender receives your FICO® Score, "key score factors" are also delivered, which are the top factors that affect the score. Addressing some or all of these key score factors can help you improve your financial health over time. Having a good FICO Score can put you in a better position to qualify for credit or better terms in the future.

The point above which a lender would accept a new application for credit, but below which the credit application would be denied, is known as the "score cutoff." Since the score cutoff varies by lender, it's hard to say what a good FICO® Score is outside the context of a particular lending decision.

Read our FICO® Score FAQ (PDF)

Receive your credit report from the three major credit bureaus at annualcreditreport.com

Resources to move you ahead.

See how you can keep your finances on track.

Make sure you are both on the same page.

Learn how to manage your increased salary.

Discover which option is right for you.

*FICO® SCORE TERMS: Your FICO® Score and key factors are based on data from Experian and may be different from other credit scores. This information is intended for and only provided to members who have an available score. Your score is provided on Mobile Banking with key factors for individual and joint accounts. Partner Colorado uses the FICO® Score provided to you, along with other information in credit decisions. This benefit may change or end in the future. FICO® is a registered trademark of the Fair Isaac Corporation in the United States and other countries. Partner Colorado and Fair Isaac are not credit repair organizations as defined under federal or state law, including the Credit Repair Organizations Act. Partner Colorado and Fair Isaac do not provide “credit repair” services or assistance regarding “rebuilding” or “improving” your credit record, credit history or credit rating.