Bill Pay Upgrade

The New Bill Pay System Is Now Live!

We’re excited to announce that our upgraded Bill Pay system is now live, featuring a fresh new look and more user-friendly features. You can now access and start using the new Bill Pay system right away.

Please Review Your Payees

While the upgrade preserved most of your existing Bill Pay information, we recommend reviewing your payees to ensure all payment details are current. It's not uncommon for account numbers, addresses, or payment methods to change. For example, some check payments may now be processed electronically, or vice versa.

eBills Need to Be Reset

If you previously had eBills set up, you'll need to reset them in the new system. For security reasons, passwords and login information from other websites did not transfer.

Re-Add Person-to-Person Payments

If you use person-to-person payments, those will need to be re-added in the new system. Once set up, recipients may be able to receive payments instantly, depending on their selected method.

We hope you enjoy the new and improved Bill Pay experience.

Frequently Asked Questions

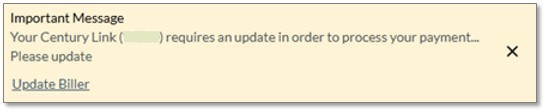

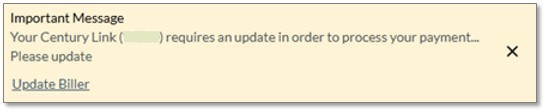

At the top of the Bill Pay page, you will see a highlighted box similar to the one below that will notify you to make an update. The notice will provide the name of the biller and the last four digits of the account number.

Questions regarding paid bills should be directed to our Contact Center, and they will be able to research the payment for you.

No, you can set up a default account.

Payments are attempted to be sent electronically first. If they cannot be sent electronically, they are sent via check.

Electronic payments are delivered the day after the send date. Checks are typically delivered within 5-7 calendar days after the send date.

You can schedule payments via the delivery date.

The exact name of the biller, your account number, and the ZIP code+4 of the biller (i.e. 80504-1234). This information should be available on your most recent bill.

If the biller is not currently set up to receive electronic payments, a check will need to be mailed and thus we will need the full address.

- Electronic Payments: Funds are withdrawn from your account after the 3 pm cutoff time the night of the send date.

- Checks: Funds are withdrawn from your account when the recipient cashes the check.

Yes, the fee is $25.

The frequency options are: One-time, weekly, monthly, quarterly, annually, every two weeks, twice a month or every six months.

When you choose to cancel it, after a certain number of payments or you can select an end date.

Failed payments due to insufficient funds are not automatically resubmitted. You must manually reschedule the payment.

Yes, you will receive a warning when scheduling a potential duplicate payment to a biller with the same account number and same payment amount.

Businesses can have multiple users on the account and can pay multiple invoices with a single payment by setting up invoice details. Invoices are always paid by check.

An eBill is an electronic bill – a digital version of a tradition paper bill.

No, due to security measures, eBills will not transfer over and you will have to set them up again in the new Bill Pay system.

No, only some companies offer eBilling.

Yes, you will be able to see your statement immediately.

Yes.

You can set a custom rule for the maximum payment amount. When a bill exceeds the amount you set, instead of paying the bill, the system will send you a notification.

You can search for transactions by biller, person, or account name.

You can filter by date range, or by the product (Pay a Person, Pay Bills, Make a Transfer).

You can search for the biller by entering their name exactly as it appears on your statement.

Select “I don’t have account number” and enter the information.

Bill Pay constantly adds new billers. As a biller comes online, they will be added automatically and payments will go out electronically instead of checks.

At 3:00 pm, the day the payment is scheduled to send.

Yes, you can elect to receive notifications via SMS (text) or email.

The only time your Bill Pay account access would be locked is in the case of suspected fraud. Your account is protected with the use of fraud tools working behind the scenes. If it looks like there is a fraudulent transaction on your account, we will lock your account. If this happens, please call our Contact Center at 303.422.6221.

If you don’t recognize a transaction or you need to dispute a transaction, please reach out to the merchant first to try to resolve the issue. If the merchant is not able to help, please call our Contact Center and they will handle the dispute for you.

You can check your payment status in online or mobile banking. Go to Transfers & Payments. Choose Bill Pay and Pay-a-Person. Click on History under the Activity tab. Choose the transaction you are inquiring about. This will take you to the Payment Detail screen and it’s here where you will see the status of your payment.

If you need further research done, our Contact Center is happy to help. They can submit a Payment Research ticket on your behalf.

If you need further research done, our Contact Center is happy to help. They can submit a Payment Research ticket on your behalf.

Yes. This is accessible through online or mobile banking. Once you log in to online or mobile banking, go to Transfers & Payments. Choose Bill Pay and Pay-a-Person. Click on History in the Activity tab. Choose the transaction you would like proof of payment for, and in the Payment Detail screen at the very bottom, will be a button you can select that will give you a full, official Proof of Payment for that transaction, and you can even print it out.

Almost all will convert to the new system. However, because it is possible that some may not, it’s extremely important that you check your bills after the upgrade on August 18, to make sure they are correct.